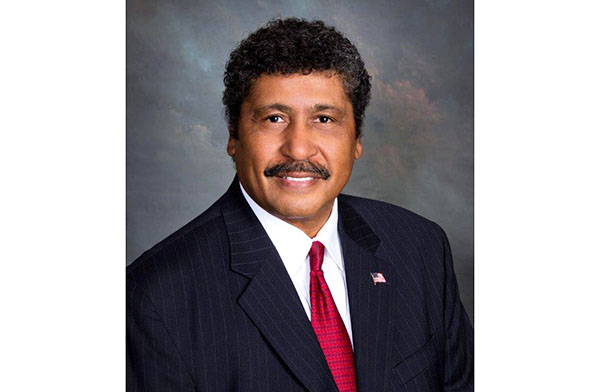

While Palm Beach County voters will decide the fate of a $200 million bond issue designed to bring about more affordable housing on Tuesday, Nov. 8, Royal Palm Beach Mayor Fred Pinto believes that the county should take a different direction on the issue — get into the affordable housing market, directly building and maintaining rental communities.

“We are making the same mistake that we have been doing for the past 10 to 15 years,” Pinto said at the Thursday, Oct. 20 meeting of the Royal Palm Beach Village Council. “It has not yielded the results that we want. We need to be thinking of a new, different approach.”

At the meeting, Skip Miller, vice chair of the Housing Leadership Council, made a presentation on the county’s bond issue proposal.

“We are asking voters to support a bond issue that will increase the supply of workforce housing in Palm Beach County,” Miller said, explaining that the county is at least 20,000 units short of its housing needs for essential workers.

Miller said that the bond issue will be used to encourage developers to build low-income housing units by offering low-interest loans to those who will build homes and apartments for essential workers in Palm Beach County. The money will be paired with other federal and state programs to extend its reach.

The program’s goal is to use this mechanism to bring down rents in Palm Beach County and provide homes for people who are being priced out of the market. Miller said that the bond issue will not fix the problems in the county’s housing market, but it will be an important step.

“The county will not tell developers what to do, rather the county will offer incentives to developers that will provide a greater per unit subsidy the lower the income level that is targeted,” he said.

The bonds will cost the average homeowner about $14 per year. If successful, when joined with other county programs, it will create 20,000 new units of workforce housing over the next 10 years. The bond money is designed to recycle, moving from one project to the next as the money is paid back.

After Miller’s presentation, Pinto was clear that he did not like the idea.

“I think it is the wrong concept to believe that we are going to incentivize the open market to solve our problem,” he said.

Miller directed Pinto to Jonathan Brown, who is the county’s director of housing and economic development, as well as the members of the Palm Beach County Commission, to voice his concerns.

While Pinto was not specific on what he would prefer at the meeting, he spoke to the Town-Crier several days later to lay out his suggestion that the county skip the middleman and just build the necessary units.

“It’s the same strategy that has been in place for the last 10 to 15 years. That is trying to get the private sector to solve a problem that is really the government’s problem to solve,” Pinto explained. “I would like to see a completely different approach.”

He does not believe that the county’s proposal will solve the issues around affordable housing.

“If that’s what they are going to do with these funds, I will not support that,” Pinto said.

Instead, he would like to see a change in the overall strategy.

“A strategy where we create a mechanism, such a corporation that is part of the county, and we hire professionals who know how to build these developments. We can build the kind of units that we need built,” Pinto explained. “We then have permanent ownership, and we have a revenue stream that will come back to us, because we have ownership and the management responsibility for these units, to continue to build more units.”

He does not believe that in doing so, the county will be in competition with the private sector, but rather taking on a role that the private sector does not want.

“We would not be competing with them, because we will be building in a market that the private sector does not want to build in,” Pinto said. “They are in the business to make money, and building affordable housing does not give them the type of revenue that they want to get.”

This new county-owned entity would not be in business to make money.

“We will build these units at whatever the cost is,” Pinto explained. “People who live there will be paying rent that we will reinvest to build more units. Every unit we build will stay in the inventory as an affordable housing unit.”

He also does not like the fact that the housing bond money can be used on both single-family and multi-family units. “We should focus on building multi-family units, not single-family homes,” he said.

Pinto does not feel that his concept should be compared to the huge housing projects that were built in major metropolitan areas around the county last century, which later became a problem with poor upkeep and crime.

“I am not suggesting that we build 20-story buildings,” he said. “These buildings will be built within the architectural models that we have here in Palm Beach County. We can manage to those issues. Those are lessons learned so that we can do them properly.”

In his mind, there would need to be a focus on proper maintenance and security at these county-run developments. Often, Pinto said, objections to this type of housing come down to “the caliber of people who live in these types of developments.” He warned against that type of thinking.

“If we are serious about doing this, we can’t let those types of biases come into our thinking and be a reason why not to do something,” he said.

To get started, Pinto said the experts need to “run numbers and create a business plan.” He believes that the wording of the current bond issue means that, if approved, the money could be used for the purpose of the county doing the projects itself.

“We need to figure out how many units we can actually build based on the funding that is available, and then project the revenue streams,” Pinto said. “We will need to pay professionals to build this for us, and we will need to pay professionals to manage it once it is built.”

He expects that proper security will be built into the program, and the units will need periodic renovations. Properly managing it includes proactively working to maintain the infrastructure, he noted. “We are not going to be absentee landlords,” Pinto said.

In his mind, these housing units will be smaller than county averages and not include the “luxury” upgrades often seen in today’s rental developments.

“We need to be very smart in how large these units are,” he said. “These are affordable housing units. We are not trying to create luxury apartments.”

As of now, he has not engaged many other community leaders across the county in discussions regarding his concept.

“I’m willing to talk face to face with anyone who is responsible for this bond issue, whose minds I would like to change,” Pinto said. “We have to change our strategy and come up with a bold approach that is very different than what we have been doing in the past.”