On the Tuesday, Aug. 20 primary election ballot, voters will choose whether to renew Palm Beach County’s ability to give certain economic development tax breaks to employers for creating or retaining jobs.

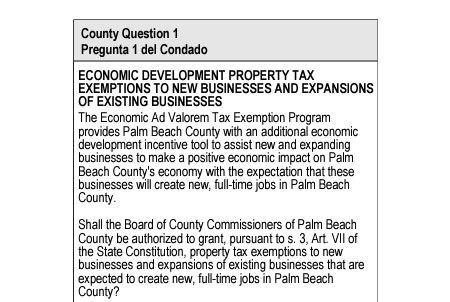

County Question 1 is titled “Economic Development Property Tax Exemptions to New Businesses and Expansions of Existing Businesses” and would continue the Economic Ad Valorem Tax Exemption Program.

Palm Beach County Commissioner Sara Baxter, whose District 6 extends from the western communities to the Glades, supports keeping the Economic Ad Valorem Tax Exemption Program.

“One of the things we need to do is incentivize businesses to be here,” she said.

A Palm Beach County staff report shows the tax breaks were used by six businesses over the last 10 years, including two firms in Belle Glade, with the majority of the financial benefit going to tech stalwarts operating in northern Palm Beach County.

County staff has recommended prioritizing projects in areas needing economic development.

Baxter said it could help if more businesses knew about the program.

“One of the things I’ve been advocating for is better messaging,” Baxter said. “The larger corporations seem to know where to look for these things. We should be trying to help all businesses.”

Promoting high-quality jobs is a key issue in her district, Baxter said at a Palm Beach County Commission meeting in January before she introduced a motion to put the renewal before voters.

The commissioners approved the referendum 6-0 with little discussion and no comments from the public.

The county tax incentives amounted to $6.25 million over the last 10 years. Combined with other forms of state and local assistance, they helped create or retain more than 5,000 jobs countywide, according to a staff report.

They helped stimulate more than $420 million in capital improvements at manufacturing plants and other facilities and created an estimated five-year economic impact of $5.7 billion, the report noted.

The minimum requirements to apply for the tax breaks call for creating and sustaining at least 10 jobs.

Recipients of such tax breaks between 2013 and 2023 have included Finfrock Enterprises LLC, a builder of pre-cast concrete structures with operations in Belle Glade, records show. It received $400,000 in ad valorem tax incentives.

Another was Tellus, a maker of sustainable plates and packaging using sugarcane fiber, with a manufacturing plant in Belle Glade. It got $850,000 in tax breaks. Tellus is jointly owned by three parent companies, Florida Crystals Corp., the Sugar Cane Growers Cooperative of Florida and American Sugar Refining Inc., according to its web site.

The agenda item considered by the county commission included recommendations from county staff.

“Staff is recommending that if the program is approved by the Board of County Commissioners and subsequently by the voters, that the program criteria provide a preference for businesses locating or expanding in low-income census tracts where a majority of households have a median income of 80 percent or less or a poverty rate of 20 percent or higher,” according to county reports.

Many companies taking advantage of the tax breaks are not necessarily operating in lower-income settings.

Beneficiaries in the last 10 years have included Pratt & Whitney, which develops aircraft engines west of Jupiter. It saw almost $1.4 million in tax breaks. Another $3.6 million combined went to Carrier, Otis and other technology and equipment providers in or near Palm Beach Gardens.

The tax inducements, along with other aid such as direct state and local grants, have resulted in 2,246 jobs retained and 2,800 jobs created in the last 10 years, according to the staff report.

Documents describing the program’s purpose refer to attracting companies to locate a facility in the county or expand an existing one. Large companies tend to find the process easier to navigate than smaller ones. Individual applications come before the county commission for approval, and typically involve a compliance and verification agreement with the county and a letter of credit or cash bond to secure approval, records show.

The program has twice been authorized by voters for 10-year periods, in 2004 and 2014.

A YES vote on the Aug. 20 ballot will extend the program for another decade. A NO vote denies permission to the county to continue offering such incentives. The matter is open to all voters, even those registered without a political party in a voting period largely associated with party primaries.

Another government handout only big business, including the worst ones like the sugar industry, get to take advantage of at our expense. NO NO NO